If you are looking for a far more outlying and residential district existence – where the cost-of-living is typically lower – a good USDA mortgage will save you cash on their down payment and you will interest.

The capacity to really works from another location has created an alternative possible opportunity to real time everywhere you want. Since the COVID-19 limits is actually slow elevated, more a third from staff declaration proceeded to focus from household no matter their workplace starting backup.

There can be just one question – discover a great USDA mortgage, you need to see a qualified assets. This is when the new USDA financial chart will come in.

What is a good USDA Loan, and exactly how Would you Make an application for You to definitely?

Mortgage loans regarding the U.S. Institution from Agriculture was fund that are meant to service low-income family members finding sensible housing outside of biggest urban centers. These types of finance are usually advisable to have individuals whom would not or even be eligible for a vintage financial.

The initial benefit of a good USDA loan would be the fact it will not wanted an advance payment – which might be the largest monetary hindrance so you can homeownership. The fresh new funds work with to own 31-seasons terminology at the fixed interest levels (somewhat less than conventional money) and can be used to purchase manager-filled, single-family unit members property and you may apartments.

The newest USDA application for the loan procedure begins with deciding your own qualifications, which depends on your revenue, credit rating, or any other debt. For folks who qualify, you could potentially run an effective USDA-approved home loan company in order to secure a home loan pre-acceptance and commence interested in USDA-accepted belongings.

Eligibility Conditions to possess USDA Home loans

New terms of a great USDA financing might be high, however, they aren’t for all. To make sure you tend to qualify for one to, you’ll need to meet up with the following requirements:

- Your income needs to be contained in this 115% of one’s median domestic money restrictions specified to suit your area

- You really must be an effective U.S. Resident, U.S. non-resident national, or licensed alien

- You will likely you would like a credit rating away from 640 or above

- Debt obligations shouldn’t exceed 41% of your own pre-income tax earnings

- You should agree to personally entertain the dwelling as your top house

- It must be discovered contained in this an eligible outlying city

- It should be one-family unit members house (which includes condos, modular, and are made residential property)

- There’s no acreage restrict, however the worth of the fresh new home should not go beyond 30% of your property value our home

Professional Idea

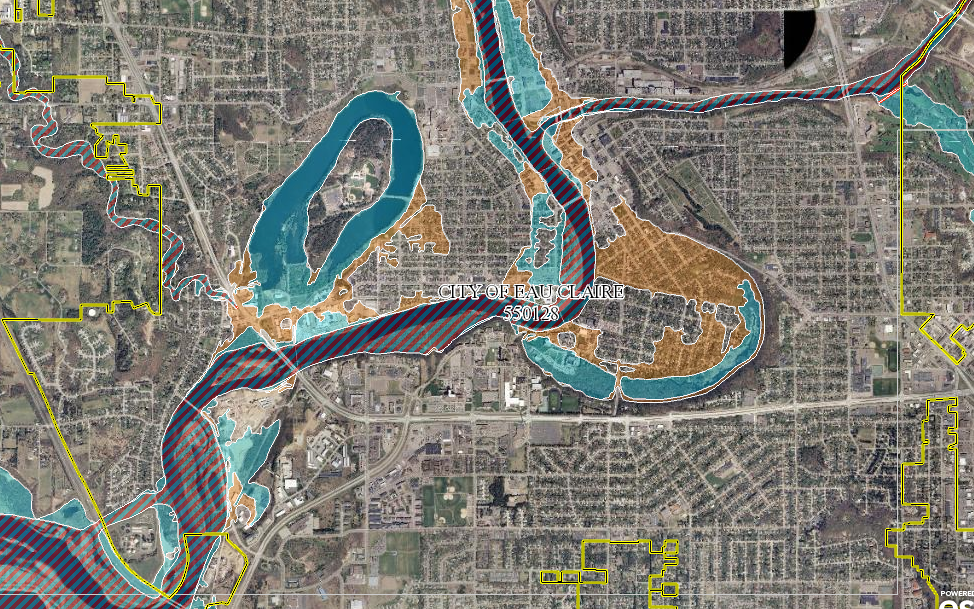

Before you could get addicted to your brand new potential house, browse the USDA interactive map to find out if it is eligible.

Just what Qualifies because the good Rural Town

Before you adore people type of family, you’ll need to understand which elements in the area meet the criteria on the USDA system. How USDA defines rural section depends on where you happen to live.

As a whole, this type of portion is defined as open nation that isn’t part of, associated with people city www.simplycashadvance.net/loans/loan-for-vacation/, said Ernesto Arzeno, a mortgage creator with American Bancshares.

The fresh new rule of thumb was components having an inhabitants with shorter than ten,one hundred thousand, Arzeno said, regardless if one to code isn’t hard and timely. For the majority of portion, depending on homeownership cost, the fresh USDA lets communities doing thirty-five,000, but don’t more than one. And also the designations may change just like the USDA ratings him or her all of the very long time.

Utilizing this new USDA Mortgage Chart

The fresh new USDA’s interactive financial chart is the unit you to definitely allows the truth is when the a house is eligible. It truly does work in 2 implies: You can look personally towards the address off a house you’re given, and it will surely make you a reply about qualification. Otherwise, you could potentially navigate inside the map to determine what areas basically are believed rural.

- Discover brand new USDA Mortgage Chart right here.

Visitors using this chart is not very distinct from having fun with Google Charts or any other similar equipment. However, below are a few what to consider when using the USDA financial chart:

Is an excellent USDA Mortgage Right for you?

USDA Lenders is going to be an effective path so you’re able to homeownership, particularly when you are looking to live beyond an enormous area. But with one financing, you’ll find positives and negatives. Here is what to adopt.

A monthly financing payment (exactly like personal financial insurance policies) was placed into the borrowed funds commission. It cannot getting canceled once getting together with 20% collateral.

It is critical to high light the newest economic downsides. Skipping an advance payment means it’s possible to have an enormous loan total spend focus into the. And additionally, a month-to-month funding payment commonly sign up for a full time of people USDA loan. With that, make sure you thought every mortgage funding choices to see and therefore could be the finest complement your.