The favorable Recession is an effective finest storm’ causing an almost-overall failure of your United states financial system – exactly what is the main cause?

Globally Financial crisis in australia

Compared with the usa and many more build regions, Australia fared relatively really from the GFC. A technical recession counts because a couple of straight residence from negative GDP increases. Australia just had one – , employing because of the 0.5%.

Australia’s GDP results is actually supported by a powerful iron-ore speed, inspired of the China’s insatiable interest in metal. It hit a top off USD $195 each tonne when you look at the 2008, and you can lived extremely increased until the prevent out-of 2011, except that a brief drop during 2009.

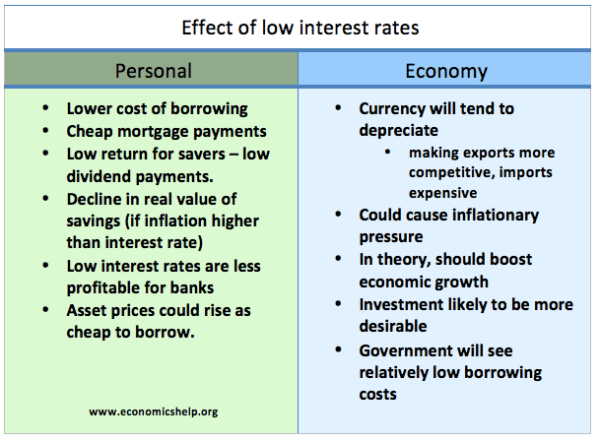

The latest Set aside Bank regarding Australia together with got their trick gun in a position to flames – the cash price. They eased economic plan, reducing the bucks rate away from seven.25% within the . This generated wholesale resource for financial institutions decreased, paid off mortgage rates and facilitated paying. In love to consider a finances rate out-of eight.25% now…

Borrowing from the bank increases strike a premier regarding sixteen.2% during the . Jobless has also been a virtually number reduced cuatro% in , if you are underemployment has also been lower at 5.7%.

Alleviated economic rules has also been supported by the fresh new Rudd Government’s stimulus policies – after that questionable, but miniscule in the context of Covid. Having users, individuals making lower than $80,100000 a year acquired a-one-time bucks commission out-of $950. Someone used you to buying huge Tvs – merchandising change increased cuatro.1% within the . There can be along with a good raft from team support strategies and you can system strategies put in place.

Taxation as the a percentage away from GDP was also within an archive reduced courtesy such ages, helping support family and you may team investing, but features mounted a bit substantially since.

How it happened so you’re able to Australian home values throughout the 2008 Overall economy?

Hold prices were seemingly unaffected from crisis’, having assets rates development postponing throughout the one-fourth, ascending from the just 0.8% – slower than simply step 3.7% development in the previous quarter – according to Website name.

Last year, new national average dwelling price sprang step 3.5% on the Summer one-fourth, 3.9% when you look at the September’s, and you will cuatro.6% from inside the December’s – slightly this new evaluate on You.

RBA’s up coming-Secretary Governor Boy Debelle told you Australia in addition to United states was in fact equivalent in financial trouble-to-earnings rates and you may house-to-financial obligation rates, however, explained as to the reasons Australia’s housing marketplace overall performance are other.

The newest shipment out of loans is pretty some other. Subprime financing makes up about a highly brief display of Australian home loan markets, Mr Debelle told you.

The bulk of domestic debt in australia could be due because of the people who have the highest earnings that happen to be most able to services their loans.

Non-compliant [subprime] funds in australia taken into account just about step one% from a great financing inside 2007, better look here beneath the 13% subprime share in the us.

It wasn’t all the rosy, with lots of people and livelihoods providing a bump, and also the outcomes will always be seen now.

Underemployment

Underemployment enjoys fundamentally remained elevated because GFC. Underemployment is actually identified as those who are employed but aren’t taking as much times because the that they had particularly.

Section of this can be attributed to an upswing of concert economy eg food birth, rideshare and you will gig networks eg Airtasker. not, secure stable complete-big date a job provides arguably been much harder to find because GFC.

It got more than 13 ages getting underemployment to return to help you its pre-GFC profile. Including, skilled business opportunities only retrieved regarding post-GFC slump from inside the .

Bank purchases

To the Westpac finished the purchase of St. George for the a projected $19 billion offer, considered to be dos.seven moments book’ really worth.

Commonwealth Lender acquired Bankwest from United kingdom lender HBOS for the late 2008 for an amount of $dos.1 mil – an estimated 20% lower than book’ worth.

On one to stage, CBA has also been rumoured to stay talks that have Suncorp so you’re able to and obtain the banking and you may wealth administration companies.

You will need to observe that these businesses weren’t necessarily to your brand new verge out-of collapse just as in of numerous lenders from the United Claims, rather the big banking companies watched value in bidding with the faster lenders’ thinking struck by recession.

Share avenues

Share areas had spooked in australia. The latest The Ordinaries’ worst date from inside the crisis is actually whether or not it plummeted 8.2%. The worst 12 months has also been 2008, decreasing %.

The fresh new ASX two hundred peaked during the six,700 circumstances into , in advance of persisted drops over the 2nd sixteen months, bottoming away during the 3,124 factors on .

Investing and inertia

Before and you may throughout the Covid, the brand new government’s content to help you people is Spend cash!’. It was even with guaranteeing a unique fiscal duty, obtaining the latest Funds back into black and you will rein in Australia’s financial obligation.

However, inflation might have been slow, also inspite of the RBA reducing the cash speed out of cuatro.75% this season down seriously to a reduced away from 0.10% by .

The nation as well as experienced an each-capita recession throughout the second half out of 2018 – declining 0.1% about September quarter, and you can 0.2% on December one-fourth. For every capita recessions reference productivity for each and every person declining for two successive home.

If you’re Australia fled a scientific recession, aches try believed in many other areas, towards the GFC leaving an enthusiastic indelible mark for the benefit.