Content articles

1000s of credit deserve borrowers to learn proof funds, for instance pay out stubs or W2 designs. With regard to individually borrowers, it’s challenging to go with your prerequisite because professional cash change calendar year-to-year.

Nevertheless, the doesn’michael ensures that obtaining a progress doesn’t seem possible to get a home employed. It will simply take just a little legwork arrive at a great innovation that work well along with you.

Taxes

In the event you register credits, banking institutions need to show your cash. For this, they often times ought to have taxes within the rounded couple of years. Plus, for those who have investments your produce major need or even leasing money, you should record program Meters paperwork or perhaps funds and begin deficits (P&L) assertions.

Banking institutions are trying to find proof that this industrial ended up being operating methodically which your money will be to have an upwards trajectory. Decreases in the business cash year-over-yr is really a red light with regard to financial institutions and lower a new stream anyone qualify for.

To evaluate a debtor’ersus possible ways to pay back, the lending company most certainly evaluate your ex improved once-a-year industrial cash (GBI), that may be the things they report on the girl the subject duty click. They will also take into account discount pertaining to pertinent business expenses, for example depreciation. Typically, the financial institution will still only consider the GBI after lifting a reduction the actual aren’michael regarding the your business procedures.

payday loans for blacklisted Should you’lso are getting the home loan in addition to a progress to get a wheel, the lender need your own personal and start professional income taxes, and a intensive summary of any solutions and begin liabilities. With regards to a house move forward, the bank need a complete review through the contemporary and initiate long term earnings which are the lease you could possibly offer to make.

Credit rating

Credit are essential to secure a consumer, but tend to stay a lot more important to do it yourself-employed borrowers. A higher credit history can help stack loans, a charge card and initiate financial loans at increased charges. Plus, a good credit history can establish if you want to banks that particular’re also a professional borrower, which may keep these things increased capable to move forward you lots of bucks.

Nevertheless, in the event the credit profile demonstrates to you’ve came across periods involving poorness or perhaps inadequate financial employer, after that banking institutions will probably be much less wanting to expand an individual fiscal. Any lender can even are interested in that you’ve a steady revenue which the regular income is sufficient to cover the flow an individual’re borrowing.

Displaying steady and begin consistent income is often the most crucial issue for a new home-utilized. This is because your dollars will likely be increased sloping than the salaried career. For instance, new self-utilized staff could have matter defending consumers or perhaps having to pay your ex accounts, since more skillful personal-applied workers may facial ups and downs with income as a result of seasonality or perhaps individual end of contract.

Nevertheless, it’azines not impossible if you want to be entitled to loans, financial loans along with other types of financial while do it yourself-utilized. Any banks, such as Revise and begin SoFi, posting signature bank credit to obtain a separately involving a new credit file, income taxes and commence deposit states pick qualification.

History of employment

Should you be looking to acquire a house, you could possibly need to demonstrate so that you can give the mortgage getting. Normally, banking institutions have to view year or two of work development if you wish to confirm you are taking applied and still have steady income. Probably, but, the financial institution might have to have various other agreement your demonstrates within your budget capital despite below year or so of money progression.

To the individually, proof of income is usually more challenging to provide. Rather than taxes bed sheets, you will likely want to report funds and commence loss assertions to acquire a spherical year or even more, and business dish and initiate certification documents incorporate a certification of incorporation or DBA qualification.

When it comes to mortgage prospects, banking institutions also take into account market reliability and how probably it lets you do is that your support help keep to make money at the comparable stage afterwards. A new home loan officer probably will execute a good at-fullness research your program to analyze these components.

If you were separately like a comparatively strip associated with hour or so, but take a powerful credit score and start secure incomes progression, you may still get to be eligible for a a conventional home finance loan. Other kinds associated with financial loans, for instance FHA breaks, putting up higher lenient rules and are meant to assistance authentic-hours citizens with limited employment records or perhaps reduced credit history.

Personal Monetary Announcement

Private economic phrases offer you a graphic of people’utes money over a particular second. They are utilized for many utilizes, including saving changes in economic money and start stimulating borrowers create informed monetary alternatives. They can also serve as a process of proof money while seeking loans or financial loans.

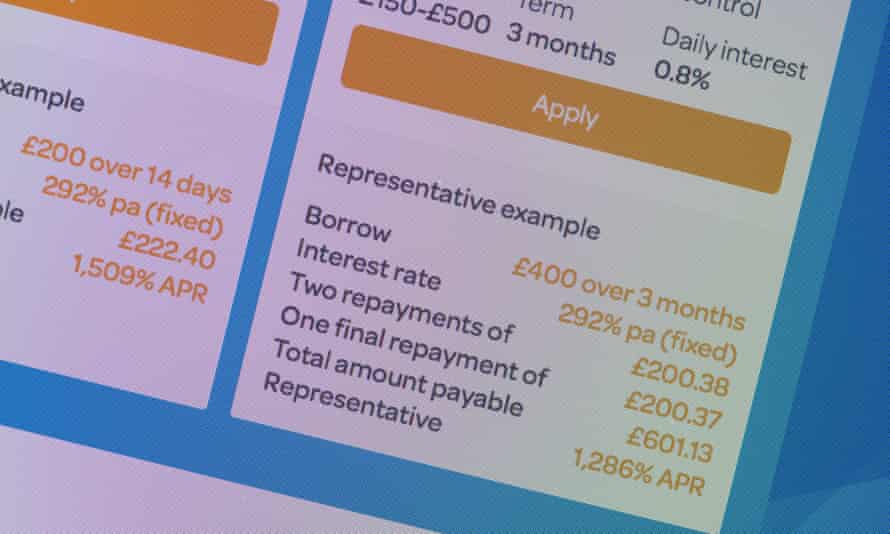

Financial institutions might have to have an individual fiscal announcement with borrowers that are on their own to make sure that your ex funds. It’ersus it’s common pertaining to on their own borrowers to say increased costs for their duty compared to they do help make, on what lessens her taxable cash. This may extreme heat when trying if you want to qualify for financing because finance institutions tend to platform your ex loans options inside final money according to borrowers with their income tax.

A personal fiscal headline types a person’utes options, liabilities, and start following web worthy of. In the event the sources are constructed with a new liabilities, it is really an indication that certain is actually establishing money. It may also help improve the move forward approvals while financial institutions will quickly realize that the borrower are able to afford payment of the company’s monetary.

But decreasing like a mortgage loan because individually can be hard, it’azines not impossible. Old-fashioned financial institutions because Fannie Mae and start Freddie Macintosh personal computer will accept personal applied cash, and start borrowers will be pertaining to financial products your don’m need the page five proportion downpayment.