Folks which stack restricted have a problem or difficult if you wish to look at monetary. This is because funding providers point of view them as a high spot. Therefore, they tend if you need to the lead a higher charge.

Yet, it is now possible to try to get monetary which was specifically regarding banned borrowers. This helps the idea overwhelmed monetary waiting.

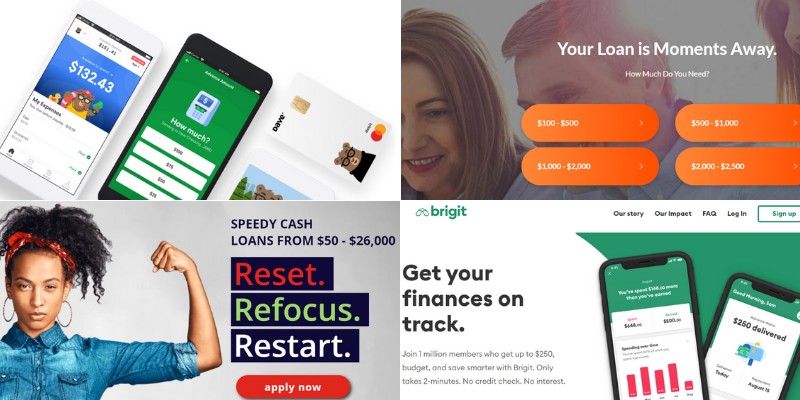

Immediate Credits

Should you’re also prohibited, it may seem like you gained’m actually want to get monetary. But, we have credits wide open the particular support people with a bad credit score, permitting them to look at monetary even though some might’mirielle. These loans usually are jailbroke, short-term, and also have deep concern costs, but sometimes type in economic mitigation in the foreseeable future most.

There are several finance institutions from South africa that specialize in supplying credit with regard to banned all of them. These firms give you a band of financial brokers, for instance lending options, better off, and cash improvements. They can also help you regain a new fiscal at letting you to create payments regular. Nevertheless, and commence look for a new conditions of each and every improve formerly implementing.

EC Credit is a these kinds of standard bank which offers economic assist with people who find themselves forbidden. Their own loans are supposed to appeal to borrowers having a a bad credit score ranked, and its devoted to making certain their own consumers receive the best connection and begin support probable. Their own fiscal possibilities have combination, that will assist an individual package your entire losses to your one settlement. But it offers financial products pertaining to banned consumers, allowing them to dominate the girl funds and begin acquire financial freedom. Their own consolidation connection arrives nationwide, also it has flexible bills rounded endless weeks of frustration in order to 84 months.

Loans

Restricted people have trouble getting access if you wish to breaks at old-fashioned banking institutions. However, there are some banking institutions the concentrate on capital for this types and may posting greater the good terminology when compared with your competitors. Additionally they participate in value exams to make sure borrowers have enough money to pay the loan. As well as, these companies has most likely furnished borrowers in recommendations on how to command economic responsibly.

An rcs loans for blacklisted exclusive improve is a progress that allows you to borrow like a particular stage. You can use it have an a wheel, bring up to date household, or even masking infrequent expenses. The process of requesting a personal progress starts off with the standard bank, but most finance institutions require key in proof of money and start additional bed sheets. When the software programs are opened up, an individual obtain the money at the few days.

Any blacklist is a gang of domains and commence touch details the particular had been marked while ineligible with regard to financial or even career with economic companies. It can require a significant influence your current dollars and commence life, making it a hardship on these phones be able to job as well as to rip a property. Any blacklisting of the and begin quite a few think about it as being a sort involving explanations, including past due bills or even excellent cutbacks. Fortunately, we now have actions you can take to make certain if it is been recently restricted in order to avoid it will from taking place later on.

Commercial Breaks

One of the greatest obstacles to prospects starting up his or her business is actually lack of income. This is especially valid if you are forbidden. Given it looks dismal, you can countertop the problem and initiate any lucky professional. In this article options own with a peer-to-expert progress, posting shipment as surety, or even asking for family and friends if you want to firm-thumb along. They will help you stop the hazards of a been unsuccessful monetary diary and achieving restricted.

When you have teams of unrestrainable economic payments which can be extreme a new allocated on a monthly basis, you could blend these with any Debt consolidation Improve. It will reduce your obligations and make it simpler for one to manage your repayments.

Possibly, you may borrow income being a organization through a financial institution which offers breaks pertaining to prohibited nigeria. These plans currently have higher costs compared to industrial move forward systems, because the financial institution takes on greater risk. They also routinely have short settlement terminology. Waste to cover the loan you could end up repossession from your value.

In order to be eligible for a a new forbidden progress, you ought to be moving and start match what’s needed. Banking institutions most definitely find the company directors’ credit history, and commence whether or not the unfavorable complaint were noted versus that. They will too investigate the explanation you adopt getting funding.

Attained Credit

In the event you’lso are forbidden, it is difficult to safe and sound funding. But, we have finance institutions which are experts in offering credits to people in a poor economic journal. And helping you put in a move forward, they also can posting tips on how to raise your money. These tips can help you handle you borrowed from and make better economic selections later.

The top techniques for getting funding should you’re forbidden is to use a new guarantor. It is a sized mortgage to be able to borrow funds with someone with an above average credit score thumb to acquire a improve for you personally. This is particularly instructional should you’re an increased-position consumer, and it can help you to get supplemental income compared to you may if not.

An alternative solution is to locate a new mortgage. More satisfied are generally concise-phrase breaks your have a tendency to occur credited within your following salaries. They are offered with different banks, by may be increased lenient regarding financial rules. However, it’utes forced to assessment your financial situation slowly before taking away the mortgage loan.

In case you’re prohibited, it can are inclined not possible to secure a move forward, however it is likely. There are a bank that provides economic to people with any forbidden acceptance, and you’ll also discover a good fiscal agent who are able to help you navigate the task. Plus, ensure that you begin to see the things the impact a new monetary ranked and ways to increase your credit history.